Since the election, chip stocks have dropped 3%. The S&P 500 is up roughly the same amount in the meantime.

Over the past four months, semiconductors, which were once the cornerstone of this two-year bull market, have actually hurt US stocks.

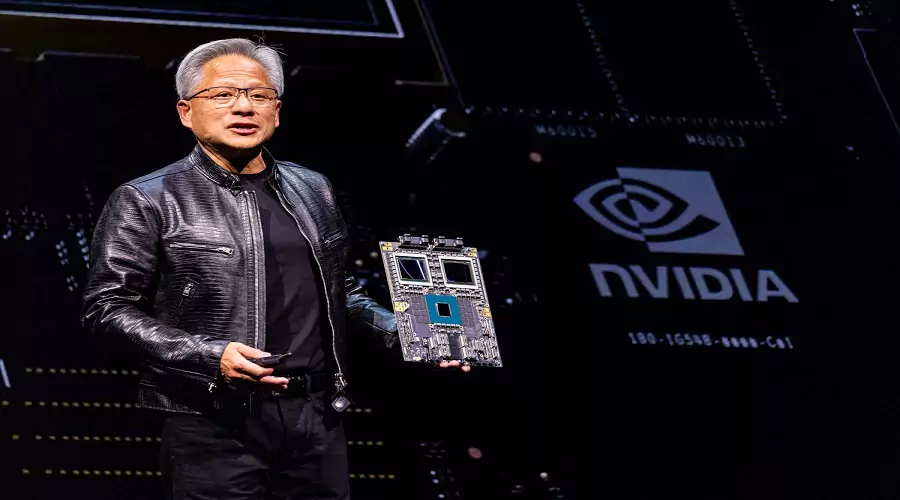

The reality check on how crucial the AI poster child (and its cousins) are to this rally will be provided by Nvidia’s (NVDA) earnings, which are scheduled to be released after the bell on Wednesday.

Recently hired by Yahoo Finance, Tom Essaye, creator and president of the Sevens Report, outlined the main criteria that traders are looking for in Nvidia’s earnings on Wednesday.

“The key is the direction. “How aggressive and enthusiastic [Nvidia is] on the guidance,” Essaye remarked. This is a narrative of growth. We are all aware of it. It’s the future. The next big thing is this. They must use this profit report to keep us enthusiastic about it.

Since its July decline, Nvidia has recovered spectacularly, increasing 45% from the significant August low. After the election, the chip stock reached all-time highs, up around 200% this year and more than 1100% in the previous two years.