Investing.com— Tuesday saw the S&P 500 close higher as equities overcame previous worries about escalating tensions between Russia and Ukraine thanks to a tech rally driven by Nvidia.

At 4 p.m. ET (2100 GMT), the NASDAQ Composite increased by 1%, the S&P 500 index increased by 0.4%, and the Dow Jones Industrial Average dropped 120 points, or 0.3%.

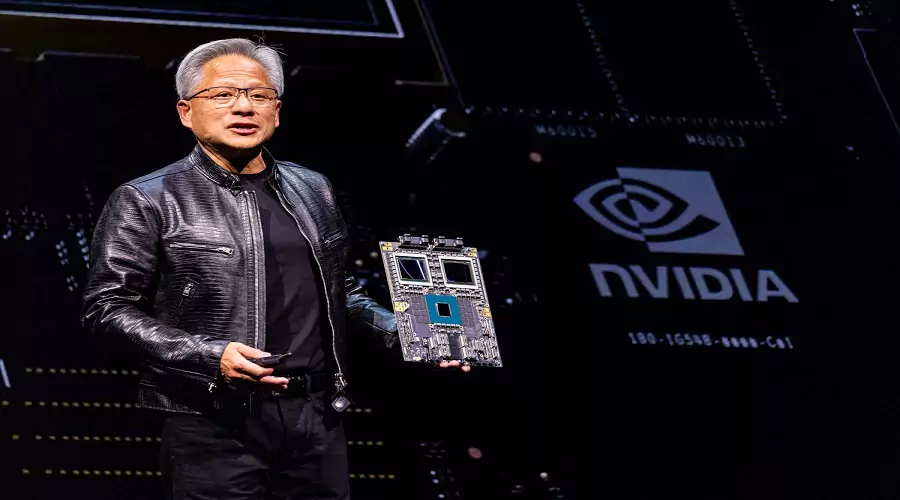

Before earnings, Nvidia leads the tech industry higher.

Just one day before its quarterly earnings report, the most valuable listed corporation in the world, NVIDIA (NASDAQ:NVDA), saw a gain of almost 4%.

Nvidia is regarded as a predictor of AI demand, and its results will probably influence the direction of technology equities in the days ahead.

Due to high demand from the quickly expanding AI industry, the company’s shares have almost tripled in value this year. The most cutting-edge AI chips available are produced by Nvidia.

In other news, server manufacturer Super Micro Computer (NASDAQ:SMCI) saw a 29% increase in value after announcing that it has hired a new auditor and was on schedule to submit its annual financial reports.

Lowe’s falters on lackluster guidance while Walmart raises projections.

With consumers purchasing more food and items both online and in-store, Walmart (NYSE:WMT) saw a 3% increase in stock price as the retail behemoth increased its yearly sales and profit projection for the third consecutive year. This could indicate that Walmart is gaining market share ahead of the holiday season.

In a report released on Tuesday, Truist Securities stated, “In our opinion, Walmart’s sustained focus on price disparities, store standards, and convenience options has enabled them to continue to gain share.”

Better-than-expected Q3 results were countered by Lowe’s Companies’ (NYSE:LOW) estimate of declining revenues in 2024, which caused the stock to drop more than 4%.